Why Most Retirement Plans Fail?

By: Robert Rothenberg, CFA, CIWM, FCSI

When new prospects come to see us, they typically ask about our rate of return assumptions when projecting their financial success in retirement.

Many individuals look at the long-term average for the stock market at 10% or a blend of fixed income and equities and average 7% over retirement when calculating the income and portfolio growth of their investments.

When people are in the accumulation phase of their life and saving money on a regular basis to fund their retirement, using an average rate of return is fine as it doesn’t matter whether your portfolio performs well at the start and underperforms towards the end or underperforms at the start and excels at the end.

In retirement, many other factors come into play when determining if your income is sustainable. One of the major factors is the sequence of returns.

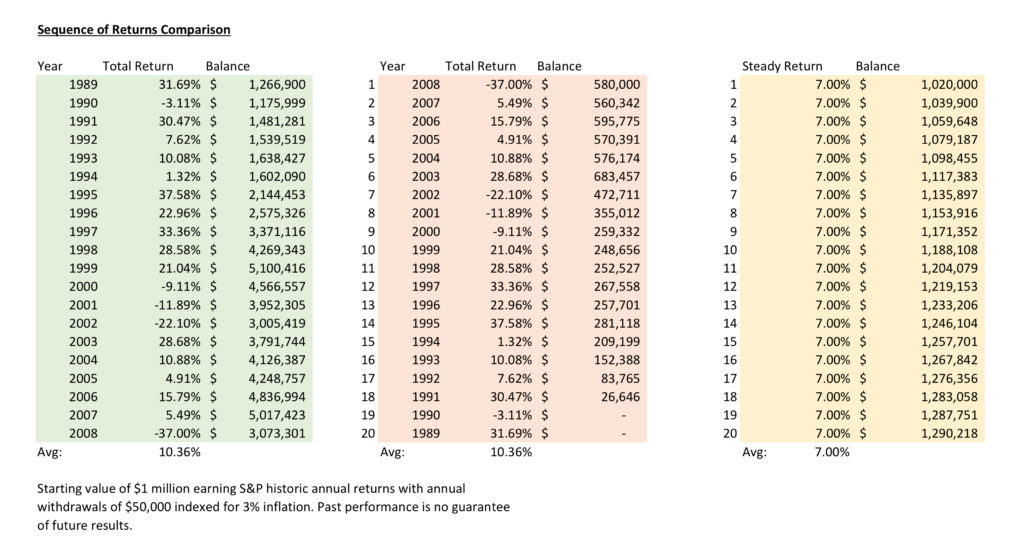

Poor returns at the start of retirement while withdrawing funds may make it extremely difficult to ever catch up. Bad timing can show that funds can be exhausted using a 5% withdrawal rate and an average rate of return of 10% in less than 20 years while the same withdrawal rate and a 7% average rate of return can have more funds than what an investor had initially when returns are strong at the onset.

The illustration shows three different examples. The first shows a retiree lucky enough to retire in 1989 having started with $1 million taking out $50,000 per annum indexed to inflation with their funds growing to over $3,000,000 in 20 years.

The second example shows the same retiree with the sequence of returns reversed with the same $1 million and the same withdrawals. This retiree would run out of money in 18 years even with an identical average return.

The third example shows a retiree earning 7%, which is considerably less than 10%, but having close to $1.3 million after 20 years.

A cash wedge strategy would be highly recommended when starting the withdrawal phase of your life. Having 18 – 24 months of income invested in cash equivalents and short-term bonds which is used to fund your withdrawals early in retirement will help ensure success if the market declines dramatically early on.

By having this cash wedge, you won’t need to sell any of your equity holdings at low prices to fund your retirement allowing time for them to recover.

In retirement, consider less volatile stocks with decent dividends or dividend growth for most of your equity exposure. When the 2008 meltdown occurred, stocks with less volatility than the overall market performed significantly better in aggregate.

The same can be said for inflation, which has been a non-factor for the better part of a decade. The historical average has been slightly more than 3% in North America with average annual rates in the 1 – 2% range. Indexing your withdrawals to inflation early on at higher rates will have a similar result as poor returns early in your retirement.

Try to keep the increase of your withdrawals below the inflation rate as this can help sustain your capital as most illustrations do index income withdrawals fully with inflation.

Taxation and costs also play a part in the success of your retirement. Maximizing contributions to Tax Free Savings Accounts is a must for individuals with non-registered funds. This can reduce the income tax payable on interest and dividend income along with capital gains substantially.

Consider pulling out some of your RRSP funds prior to age 71 if you are in a relatively low tax bracket to offset paying a higher amount of tax down the road.

Many individuals who do not have a private pension plan should consider taking out a small RRIF or annuity at age 65 to take advantage of the $2000 pension income credit.

Costs can also affect a successful retirement and eat away at returns. Ensure your overall costs are reasonable for the advice you are receiving.

By reviewing your retirement plan regularly taking into account the variables mentioned above will help you succeed where many fail.