ESG Funds: Aligning Your Investments with Your Values

ESG funds represent the perfect opportunity for investors to put their money where their values are.

Alongside heightened public awareness of environmental matters and social issues, the responsible investment (RI) movement is rapidly growing in both Canada and globally. In 2020, investors poured more than $3.2 billion into Canadian-based ESG funds.

ESG stands for Environmental, Social, and Corporate Governance. To be part of an ESG fund, the underlying companies must strive for socially responsible and ecologically sustainable business activities.

What separates ESG Funds?

Investing in ESG Funds is a type of impact investing. Impact investments are investments made to generate positive, measurable social and environmental impacts alongside a financial return.

Impact investing and ESG encourages investors to invest with purpose by incorporating personal values into investment decisions. As a result, investors are empowered with the ability to make a positive impact in the world.

In the past, impact investing carried the stigma that doing good would compromise financial returns. The underlying fear was that a company’s commitment to prioritizing people and the planet would negatively affect its financial performance and returns for investors.

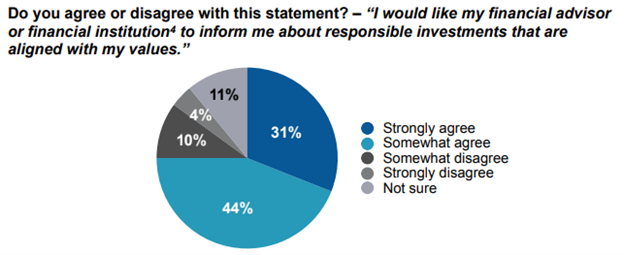

This perception has shifted as myths about ESG investing are debunked, and more and more investors embrace impact investing. A 2020 survey by the Responsible Investor Association (RIA) revealed that a majority of investors are interested in learning about RI opportunities through their financial advisor.

Breaking down the Acronym

ESG investing takes a holistic approach to investment decisions, looking beyond a company’s positive contributions to society. ESG investing also considers a company’s decision-making process and governance practices. In doing so, investors can get a better idea of the company’s efforts at being sustainable, which in the long run can help reduce a portfolio’s operational or reputational risk.

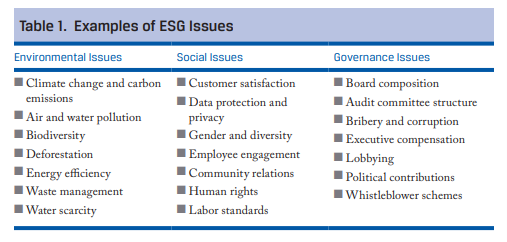

The three categories ESG funds focus on are environmental, social, and corporate governance; let’s take a closer look at each axis.

ESG Funds’ environmental vision looks for companies committed to acting in the best interest of the environment, whether by adapting their operations and/or curbing harmful activities. It focuses on companies through the lens of four major themes: energy efficiency, pollution control, waste management, and land use.

The social aspect relates to the companies’ practices when interacting with employees and local communities. ESG funds will seek companies that maintain positive relationships with the groups they interact with, including suppliers, customers, and the communities they operate in. This gives investors the confidence they are not supporting abusive practices.

Finally, governance relates to a company’s management. ESG funds will closely consider how a company manages itself regarding shareholder rights, financial transparency, and community contributions. It will also look for companies with a high standard of reasonableness and leadership. These can be combined with other issues like diversity, labor inclusion, executive/board experience, and their compensation compared to workers.

[table “5” not found /]It is worth noting that a fund integrating ESG factors may still incorporate companies with high ESG risks or poor ESG practices. This may be to understand those risks better and then engage with the companies and, through shareholder pressure, improve their ESG-related policies and procedures.

What About the Financial Returns?

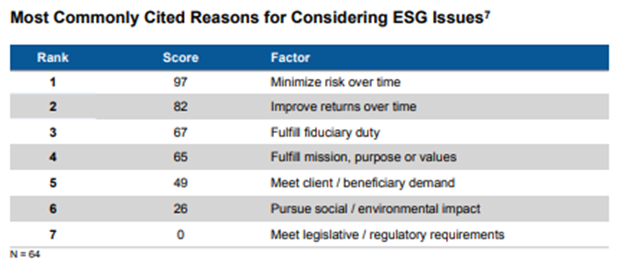

Research into ESG funds shows that investors do not necessarily give up returns to invest in ways they are proud of. Out of 2,200 studies on ESG, 90% indicate that there is either a positive relationship to Corporate Financial Performance (CFP) or at least no negative relationship. This undercuts traditional beliefs that investing according to responsible investment criteria, such as ESG factors, adversely impacts financial returns.

According to a 2020 Annual Impact Investor Survey conducted by the Global Impact Investing Network (GIIN), nearly 88% of respondents say their portfolios meet or exceed their expectations for returns. For their part, 35% of investment professionals say that they invest in ESG to improve their financial returns.

Generally, ESG funds’ returns have been spread throughout the success quartiles just like regular funds. Hence, their success is neither better nor more vulnerable than traditional non-ESG funds by investing sustainably. Most recently, ESG funds have outperformed the S&P500, although opinion on why this happens remains divided.

The fees for ESG funds are also quite varied, with some fearing ESG Funds carry higher than average fees. However, more than half of all ESG funds carry average or below-average fees. Increased competition has led to lower ESG Fund fees, making them particularly accessible to investors of all stripes.

In conclusion

ESG investing provides us with a way to make a difference with our investing dollars. It isn’t just about good business; it’s also about thinking about the future for our children and leaving a legacy we are proud of.

Are you interested in learning more about investing in ESG funds? Give us a call at 514-934-0586 (Montreal) or 403-228-2378 (Calgary), or email us at inforequest@rothenberg.ca. We will be happy to answer any questions you may have.