Canada Remains One of the Best Countries for Retirement

The Census Program provides a statistical portrait of the country every five years. The 2016 Census Program shows population growth (2011-2016) of +5%. Over the last 15 years the population in Canada grew the most among the G7 countries. Population growth was high especially in municipalities within census metropolitan areas (CMAs), while population decrease was observed in municipalities that were farther away from census agglomeration (CA) or CMAs.

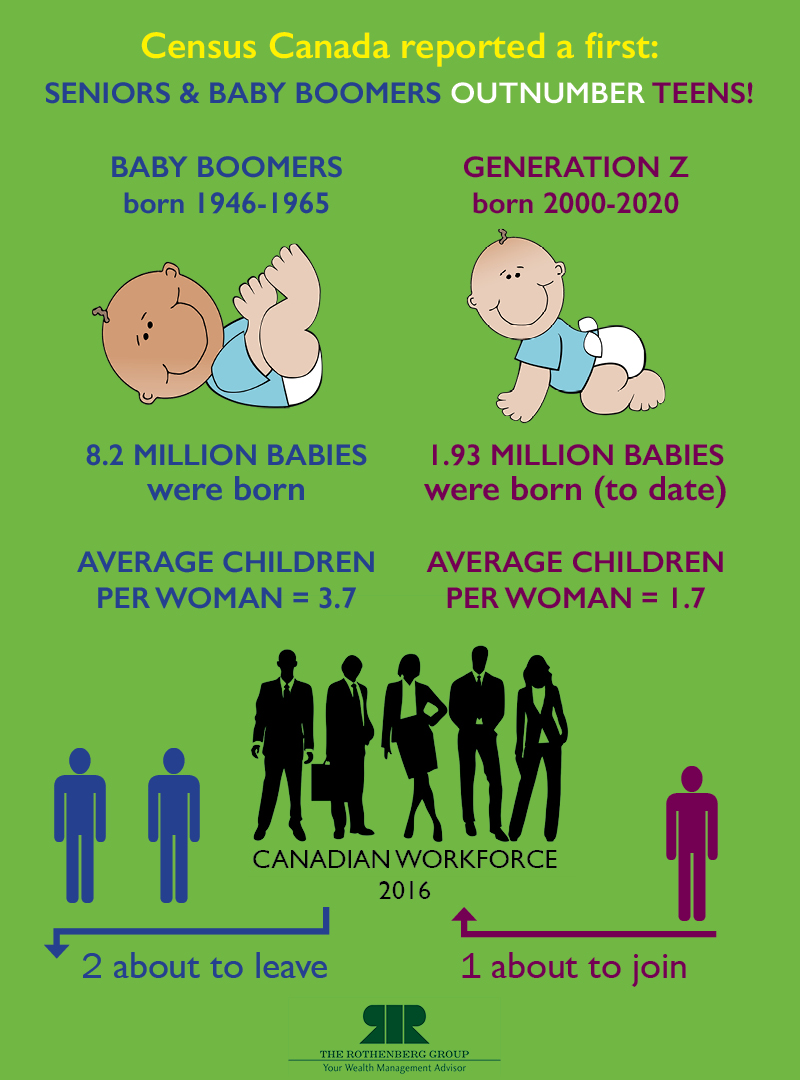

According to the latest Census, a 20% jump in the number of seniors (baby boomers) accounts for the biggest increase in 70 years.

- Median age of Canadians is 41.2 years, compared to 40.6 years in 2011

- First Time Ever: More seniors (5.9 million) than children (5.8 million)

- Prediction: by 2061 there will be 12 million seniors to 8 million children

Today, Canada has one of the highest average life expectancies worldwide with many Canadians living past the age of 80. So when coming to select the best place to retire, you might also want to consider which location can offer you the best life and not just the best place. The decision where to live in retirement is very personal and involves objective and subjective reasoning.

Medical Services Accessibility

Healthcare is at the top of the list when choosing where to retire. Regardless of how beautiful and affordable a location may be, it could be dropped off your list if access to a major hospital is difficult or if the ratio of doctors per capita is low.

Budget-friendly

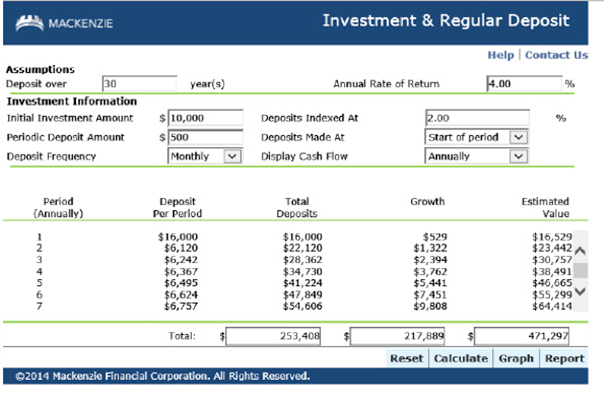

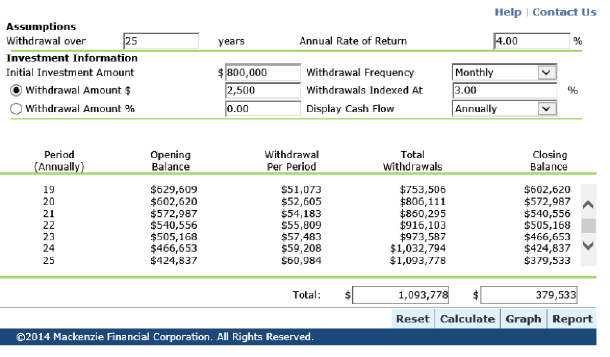

You have saved hard for your retirement and want to ensure your savings go a long way. Living on a fixed income or pension often leads people to prefer living in smaller cities with reduced cost of living.

Affordable subsidized retirement homes are very sought after and may be hard to come by. Many seniors opt for private retirement homes and use their own funds. Such choice requires careful preparation. Another important aspect of affordability are taxes. Some provinces have lower tax rates than others.

Proximity & Mobility

Imagine yourself 10-20 years from now and think how you would manage without a car. Under such circumstances, when you are less mobile, it is a good idea to look for safe and neighbourhoods with efficient and reliable means of public transport.

Family

This factor is very subjective but plays an important role when choosing where to live in retirement. Most seniors want to live closer to family or where they have some friends and acquaintances. The greatest location can quickly become a lonely place if you don’t know anybody. While relocation to a less ideal city may become attractive if your children and grandchildren are in close proximity.

Weather

Weather is a major factor for people in retirement. Most retirees, who choose to relocate, choose places with milder, warmer weather. There are differences in the number of sunny days even within Canada.

Personal Safety

Crime rates matter. If you have interest in a certain location/community try to get accurate information by contacting the pertaining police district for information on the local crime.