Relationship Disclosure

Relationship Disclosure

Services and Investments

Rothenberg Wealth Management (“RWM”) is a Level II full-service Wealth Management Firm.

We offer RRSP, LIRA, RRIF, LIF, TFSA, RESP, RDSP, FHSA, Non-Registered accounts and Margin accounts. Our accounts are cost-based, with advisory fees charged monthly in arrears. Accounts opened prior to Dec 31st, 2021, are considered legacy accounts, and are charged on a per transaction basis.

We provide a full suite of investments as described below:

- Cash and cash equivalents such as High Interest Savings Accounts or T-bills

- Fixed income or debt securities such as bonds and debentures

- Guaranteed Investment Certificates (GICs)

- Equities

- Investment funds including Mutual Funds and Exchange Traded Funds (ETFs)

- Alternative investments such as Principal Protected Notes and Principal at Risk Notes

- Options trading

Some products and services may not be available in registered accounts. In addition, liquidity restrictions (e.g., holding periods) may apply to certain securities while resale restrictions may apply to certain products such as bonds, structured products, preferred shares, etc. Please discuss this with your Wealth Management Advisor.

Your Account Type and How It Will Operate

Orders are entered after your discussion in person or over the phone with one of our Wealth Management Advisors. RWM uses National Bank Independent Network (NBIN) to execute the orders.

RWM gives you comprehensive support, tools, and resources to help you make informed investment decisions. We provide you with investment advice based on your investment objectives, risk profile and investment goals. Alternatively, your account transactions may be supervised by our Portfolio Managers based on your investment goals if you open a managed account.

The Fees You Will Be Paying and How They Will Be Calculated

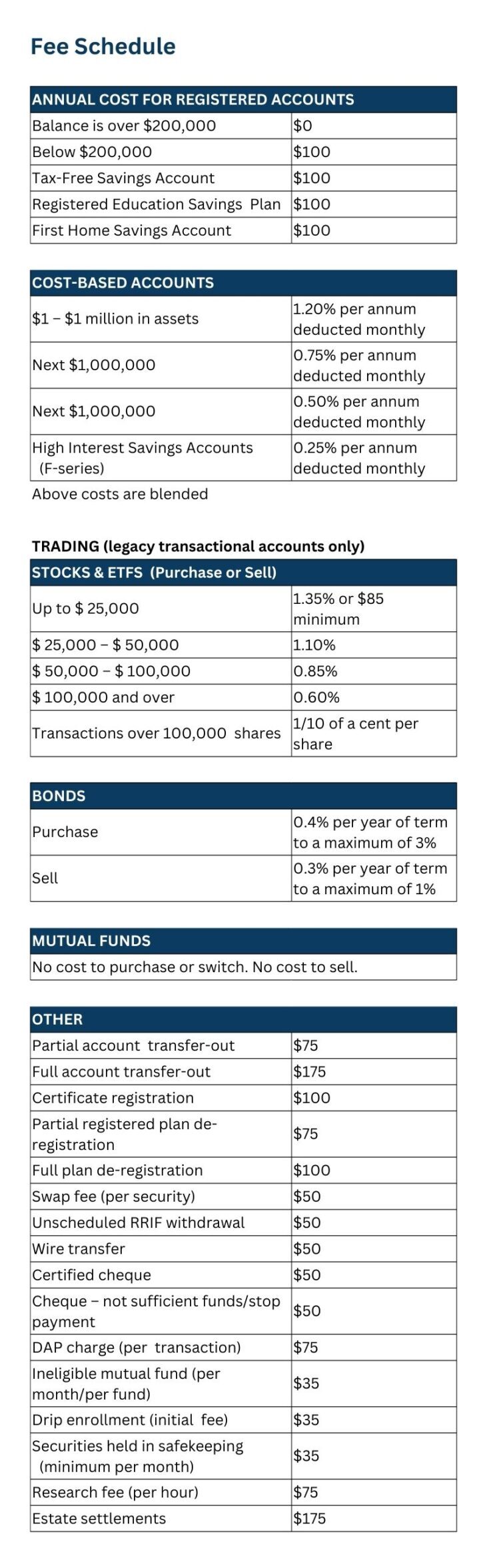

The advisory fees, or the transactional commissions you will pay for trades in legacy accounts, as well as other transactions related to the operation of your account, are included in the enclosed fee schedule.

Before accepting an instruction from a client to purchase or sell a security, in an account other than a managed account, the Wealth Management Advisor will disclose to the client:

- An exact or estimated amount of the charges paid directly or indirectly, upon purchase or sale.

- Any deferred charges that may apply during sale.

- Whether there are trailing commissions with respect to the security

There is no cost for cash held in your accounts. High Interest Savings Accounts (HISAs) are charged at a reduced rate. There is no cost for GIC holdings.

Mutual funds and ETFs charge management fees and/or have operating expenses, which are deducted directly from the fund’s assets and go toward both paying the fund’s expenses (portfolio management, record keeping, custody, reporting, etc.) and generating profits for the fund company. Management fees and operating expenses are generally charged as a percentage of the fund’s assets under administration, and this percentage is disclosed in the fund’s fund facts document, as well as in its prospectus.

With certain funds, a portion of the management fee is remitted to RWM on an ongoing basis for as long as the investor owns the fund. That portion of the management fee is called a trailing commission or “trailer fee.”

Structured Notes are a product that sometimes pays RWM a commission when a purchase is made in your account. These notes will often have a charge associated with them if they are sold within 6 to 12 months of purchase.

Initial Public Offerings, and Treasury Offerings of shares, typically pay RWM a commission when a purchase is made in your account.

Regardless of the types of costs and fees that you pay, they affect the performance of your investments. This is why your portfolio’s return is calculated net of fees. The returns shown on the investment performance report that is sent to you annually are calculated net of costs and fees.

Assessing your Unique Situation

Through an interview process and by completing a RWM Investor Questionnaire during your meeting(s) with your Wealth Management Advisor, a client profile will be built for you. The interview process and questionnaire will help determine your:

- Financial and personal situation

- Investment needs and the primary purpose of the account(s)

- Investment objectives

- Risk profile

- Time horizon

- Investment knowledge

Those details, along with any additional information you may provide, will be recorded on your New Client Account Form (NCAF). The client profile will then assist your Wealth Management Advisor in determining a suitable investment portfolio for you.

Your Wealth Management Advisor will review and update your information no less frequently than once every 3 years, except for managed accounts which must be reviewed no less frequently than once every 12 months.

Suitability

The suitability of your portfolio will be reevaluated whenever placing an order, or when securities are deposited into or transferred out of the account. Suitability will also be conducted in regular reviews (by phone or in person), if any significant event occurs in the market or with a specific holding, or if there is a change in the Wealth Management Advisor responsible for your account(s).

Suitability also means that any investment action taken, or any recommendation made, puts the client’s interests first.

How we monitor portfolio risk

All portfolios have a numerical risk limit based on the risk tolerance and risk capacity of the client, ranging from 1.0 for the lowest risk to 5.0 for the highest risk. Each security in the portfolio also has a risk number assigned using the same scale. We then calculate the weighted average risk score for your portfolio. We monitor your portfolio to ensure that the calculated risk score remains at or below your risk limit. In order to make allowances for market value fluctuations, we generally permit a risk score to go a maximum of 0.2 points higher than the risk limit before portfolio changes are required.

Content and Frequency of Our Reporting to You

Account Documents

You will be provided with a copy of the NCAF that is completed at time of the opening of the account(s) and any “Client Update” forms which will be completed on a regular basis or when there is a material change to your information.

Trade Confirmations

When you buy or sell securities, a trade confirmation will be sent to you using your preferred communication method (electronically if you are signed up for e-services or by physical mail), generally within one business day of the trade date. The confirmation will contain the following information:

- The name of the security that was traded.

- the total amount paid by you for a purchase or paid to you on a sale.

Account Statements

During months where there is trading activity in your account (exclusive of interest or dividend payments), you will receive a statement of account shortly after the end of the month. If no transactions have occurred, statements of account will be provided to you, after each Calendar quarter. Calendar quarters are March 31, June 30, October 31, and December 31. Each statement will contain the following:

- Your name, address, and account number

- The type of account

- Period covered by the statement.

- Name and telephone number of the location where the account is maintained.

- Details of each trade, the name of the security and the dollar value of the trade

- Details of all non-trade transactions such as dividends interest earned and paid, transfers and any other transactions that occurred in your account over the previous period.

- Total holdings, including name, number of units and representative market value of all securities held at the end of each reporting period.

Annual Reporting

Annually, as of December 31st, you will receive a report detailing your Investment Performance as well a summary of all the annual fees and compensation paid by you for the year.

Investment Benchmarks

Investment benchmarks generally provide a broad measure of the return generated by specific asset classes over a given period. Some common broad-based market benchmarks include the S&P/TSX Composite Index, and the S&P 500. Measuring the return of your portfolio against appropriate benchmarks can be an effective way of assessing the relative performance of your investments.

Complaint Handling

Occasionally a RWM client may express concern relating to the performance, trading or a regulatory contravention in their brokerage account(s). Any complaint should be promptly addressed to Chris Mack, the Designated Complaints Officer, who can be contacted at cmack@rothenberg.ca. Within five business days, an acknowledgement letter, providing a summary of the matter, will be sent to you. Included in that letter will be brochures provided by the Canadian Investment Regulatory Organization (CIRO) specifically addressing the complaint process, CIRO enforcement as well as Ombudsman and independent Arbitration options. You will also be provided with a copy of the CIRO complaint handling brochures at the time of account opening. RWM will maintain regular contact with you by phone or electronically until the issue is resolved, as needed.

If you are not satisfied with the response or resolution we have provided, you have other options available to you:

- Submit a complaint to CIRO (note that you may file a complaint with CIRO at any time during this complaint process). If CIRO opens an investigation file, they will notify you within 90 days and every 60 days thereafter until the conflict is resolved.

- Free mediation services offered by Autorité des Marchés Financiers (AMF)

- Arbitration

- The Ombudsman for banking services and investments if a request is made within 180 days of initial conflict acknowledgment letter.

Avoiding, Managing and Disclosing Conflicts

RWM has policies and procedures in place to assist in identifying and minimizing any conflicts of interest (COI). RWM’s board of directors has reviewed all existing material COIs and all reasonably foreseeable COIs. Any COIs which can not be avoided have been addressed in the best interests of the client. Should an unexpected conflict of interest arise, we must inform our clients or potential clients in a timely manner. For full details on our conflict of interest policies, please speak to your Wealth Management Advisor.

Conflicts with Related or Connected Issuers

Under certain circumstances, we may deal with or for you in securities transactions where the issuer of the securities or the other party to the transaction is a firm or party having an ownership or business relationship with us. Since these transactions may create a conflict between our interests and yours, we are informing you of the relevant relationships and connections relating to the transactions.

Important Concepts

A person or company is a “related issuer” if the person or company is an influential security holder of us, if we are an influential security holder of the person or company, or each of us and the person or company is a related issuer of the same third person or company.

A “connected issuer” is a party that is distributing securities and has a relationship with us that may lead a reasonable prospective purchaser of the securities to question if we and the issuer are independent of each other with respect to the distribution of such securities.

Disclosure

As is common with many financial services organizations, RWM has relationships with related and/or connected issuers. Harbourfront Wealth Management is a “related issuer” as an influential security holder of Rothenberg Wealth Management. A current list and our Statement of Policies Regarding Related and Connected Issuers can be viewed at Rothenberg.ca or can be obtained from your Wealth Management Advisor on request.

When we recommend certain investments for your account, we receive the following direct or indirect benefits that are not present when we recommend other investments for your account.

- These issuers are administered by Harbourfront’s affiliate, Willoughby Asset Management Inc. (“WAM”), which acts as the Investment Fund Manager (“IFM”) for the issuer and receives fees from these issuers for its services.

- Harbourfront provides portfolio management services to these issuers, for which it receives a fee from WAM.

- When our clients invest in one of these issuers, Harbourfront receives a separate commission or fee for providing Investment Advisor/Portfolio Manager services for the investment in your account.

- Some RWM registrants are shareholders of Harbourfront and may benefit financially from WAM’s role as the IFM of these issuers.

Please refer to the Prospectus, the Offering Memorandum, or other materials provided by the issuer at the time of distribution for a detailed description of the characteristics of each investment. Some of these investments may have limited liquidity or redemption options and may be subject to an early redemption fee. The ability to redeem these investments and/or the restrictions or fees associated with an early redemption may be important considerations when comparing these investments to other investments that don’t have these restrictions. We will endeavor to sell or transfer proprietary securities as instructed should you wish to transfer your account to another investment dealer, however, transferring these investments may not be possible in all cases.

When financial services companies have related or connected issuers, compensation received could influence investment recommendations. RWM is in a similar situation, as its registrants could be influenced to recommend investments in one of our related or connected issuers over other investments where we do not have such relationships and earn such compensation. RWM has developed policies and procedures that require our Wealth Management Advisors to recommend these investments only when it is in your best interest to do so, based on the KYC information you have provided to us. To further reduce the potential for conflicts of interest to arise, many of the investment pools that are related or connected issuers to RWM utilize a fund of funds strategy whereby they primarily invest in investment funds operated by third party investment firms.

Additionally, at the time of the recommendation, we will also disclose to you the fact that the issuer is related and/or connected to RWM. When we act as your Portfolio Manager and exercise discretion in selecting investments for your account, we will disclose these related and/or connected issuers to you at account opening, obtain your express permission to invest in these issuers in your account, and ensure these investments are made for your account only when it is in your best interest. All products, including those which are related or connected issuers, are subjected to the same review, selection criteria, and ongoing evaluation as third-party products.

Your Wealth Management Advisor does not earn any incentives when recommending related or connected investments and we have compliance systems in place that review the suitability of the products held in your account.

Checklist of Documents

We provide you with copies of the following documents relating to your account:

- RWM Account Forms

- Relationship Disclosure

- Commission and Fee Schedule

- Strip Bond Disclosure Document

- Canadian Investor Protection Fund Brochure (CIPF)

- Making a Complaint Brochure (CIRO)

- How Can I Get My Money Back Brochure (CIRO)

- How CIRO Protects Investors (CIRO)

- Conflicts of Interest Disclosure

Shared Premises Disclosure

RWM shares offices with its sister company, Rothenberg & Rothenberg Annuities Ltd. (“R&R”), a company that acts as a Life Insurance and GIC broker. RWM follows CIRO rules regarding Outside Business Activities and Conflicts of Interest.

Protection for Vulnerable Persons

RWM prioritizes the protection of our clients against financial exploitation. At the time of account opening, and when updating your client profile, we will ask you to nominate a Trusted Contact Person (TCP). While not required, nominating a TCP is recommended. The individual you nominate should ideally be someone who is not connected to you financially.

The TCP is a resource intended to help our Wealth Management Advisors protect the interests and financial assets of our clients.

RWM may reach out to a TCP, and disclose your personal information, in situations where:

- The client is a vulnerable client.

- There is reasonable belief that financial exploitation has occurred, is occurring, has been attempted or will be attempted.

- There is reasonable belief that the client does not have the mental capacity to make decisions involving financial matters.

In these circumstances, RWM also has the right to place a temporary hold on your account to protect your financial assets. If a temporary hold is placed on an account, RWM must provide notice to the client as soon as possible. Within 30 days of placing the temporary hold, and every subsequent 30 days thereafter, RWM must either revoke the hold, or provide the client with notice of the decision to continue the hold and the reasons for that decision.

Privacy Agreement

1. Collection and Use of Personal Information by RWM

When you open an account with RWM, we will obtain personal information about you which will be kept on file in accordance with industry regulations. Only authorized individuals and entities have access to this information. The information that we collect allows us to identify you, to protect you against possible fraud, to assess your potential investment needs so that we may suggest products and services to you which are appropriate for you and to comply with legal and regulatory requirements.

While RWM does not normally record its telephone conversations with clients, it may be the case that we could obtain personal information from you by phone if you should happen to call us on one of our taped lines. We record these lines in order to ensure that we have an accurate record of conversations.

2. Social Insurance Number

If you are an individual, RWM may collect, use, and disclose your SIN for income tax reporting purposes.

3. Disclosure of Personal Information to External Sources

RWM may from time to time disclose your personal information to external sources such as credit agencies, other financial institutions and other parties who provide services to RWM. RWM may also rely on external sources to collect personal information about you.

4. Affiliated Companies

RWM does not disclose your personal information to affiliated companies for non-essential services. Employees of related companies may have access to your personal information in that they provide certain services such as trade execution for RWM accounts.

5. Consent

Your consent is required before we may provide your information to any third parties. The consent that you provide to RWM with regards to the collection, use and disclosure of your personal information may be cancelled by you at any time by providing written notice to RWM. RWM does not require your consent to collect, use and disclose your personal information where such collection, use and disclosure is reasonably required in the normal course of providing service to you or your account(s), or for the collection of a debt owed to RWM by you, or to a law enforcement agency, securities regulatory authority, Self-Regulatory Organization or to legal counsel for the purpose of obtaining advice. By opening an account at RWM, you are providing consent to RWM to collect, use and disclose your personal information as set out in this agreement.

6. Corrections to Personal Information

You may review the information you have provided to RWM and make corrections to it. We may request that you provide corrections in writing. You may address corrections, questions or privacy-related complaints to Christopher Mack, Chief Compliance Officer (CCO) at RWM, who can be contacted at cmack@rothenberg.ca.

7. Retention of Personal Information

RWM may retain your personal information on file after you cease to be a client of RWM for as long as RWM requires such information or as long as required by our regulatory requirements.

BY OPENING AN ACCOUNT AT ROTHENBERG WEALTH MANAGEMENT, YOU ARE PROVIDING CONSENT TO ROTHENBERG WEALTH MANAGEMENT TO COLLECT, USE AND DISCLOSE YOUR PERSONAL INFORMATION AS SET OUT IN THIS AGREEMENT.

12/2024