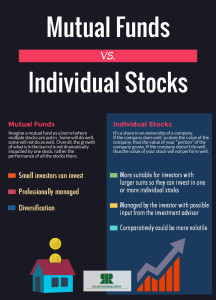

Mutual Funds vs. Individual Stocks

Let me begin by saying, the following will be easy to understand, and I’m sure each of you will feel more confident as to how to proceed with your own portfolio.

Imagine a mutual fund as a big empty round barrel. Standing next to the barrel are individuals (1 – 10 approximately, depending upon the fund) hired to preside over the contents. The idea is to fill this barrel with as much money as possible. This can range from millions to billions of dollars.

There are sales people that work for the creators of each barrel, that are expected to seek out individuals and convince them that their barrel is a good place to put their money. Either on a monthly basis, or in lump sums. As the money comes in, those individuals presiding over each barrel, known as money managers, begin to invest in the stock market, purchasing shares (stocks) of companies, bonds, treasury bills etc. There are thousands of these barrels (mutual funds) in existence today.

Some specialize in investing in only one country or in one industry while others diversify and spread the funds in many different areas. It’s not uncommon for a fund to hold as many as 50 different stocks or more.

So why invest in a Mutual Fund?

The main reason is diversification with little money. Should an investor have only $1,000 available for investment, his dollars will be put into the barrel and 50 cents of this $1,000 could be in one stock, and 2 dollars in another etc. An impossibility to do on your own.

The other reason is professional management.

Even though past performance is no guarantee of future performance you can get a feel for the astuteness of the money managers. With the help of an investment advisor, not attached to any fund, you can get advice as to which fund would meet your criteria.

So why invest through an independent Investment Advisor?

When one has more dollars available it’s possible to benefit from both worlds. Have some money invested in good solid mutual funds, and in a variety of well chosen companies.

I would like to stress that to obtain unbiased advice, it’s important to deal with an investment advisor that is not attached to any group of barrels (mutual funds) but can choose from almost all of them based on your own individual needs, whether that be income or capital growth.

Why would one invest in Individual Stocks?

Ideally this investment advisor, not licensed to sell only mutual funds, can offer you stocks, preferred shares, bonds, treasury bills etc. There is an absolute benefit in having these opportunities available when growing one’s portfolio. Without becoming too technical, the diversification that mutual funds offer, provide an element of safety, or not. By being so spread out one is vulnerable to stock market fluctuations in general, up or down.

With guidance into individual stocks, one, for example, could have completely avoided the recent drop from $115 in the price of oil to $50.

With guidance this might have been anticipated and any oil stock holdings could have been eliminated.

With guidance one might have been advised to buy the “FANG” (Facebook, Apple, Netflix, Google) group of stocks and multiplied their capital many times over.

With guidance one could invest in chosen companies, each being worth billions of dollars, have at least one billion in cash in the bank, and pay dividends on a regular basis exceeding G.I.C. and Treasury Bill rates of interest.

So there you go.

Eeeeeesy Peeeesy!