Living Well After Retirement

What a statement! “Living well after retirement”.

Brings a smile to my face. Obviously we all live well after retirement, don’t we? Or do we? Everyone waits for that special day, looking forward to the days of no work obligations, or do we? Keep in mind that a lot of us enjoy getting up in the morning and having a definite purpose in life. Going to the office or factory, seeing familiar smiling faces, tackling our work, having regular conversations during coffee breaks, lunchtime etc. is meaningful.

RETIREMENT can be very lonely and unfulfilling.

That is why it’s very important to retire into something that is meaningful. This “something” should be started a couple of years before retirement. It could be a small garden with vegetables that will expand into full size and maybe there is room to even house some chickens. It could be having the time to volunteer at that organization that you always admired. Or get more involved with your local Church or Synagogue. It could be writing a book with the goal of getting it published. Or building those radio controlled model airplanes that you thought you always wanted to do and never found the time to accomplish.

Of course it goes without saying, that one has to anticipate financial needs for that special time. Otherwise, your golden years can evaporate into lead. It’s important to live within one’s means and not compete with the Joneses throughout one’s lifetime.

Working with your Financial Advisor is important. And the earlier you start the better it will be for you. Even if you start with a small amount invested each week or month, over the years that money will grow and you will be surprised at how that snowball will become larger and larger. At any age, meeting with a professional Financial Advisor should help you focus on your own financial goals.

If you want to do a little calculating on your own, our website has a number of excellent calculators.

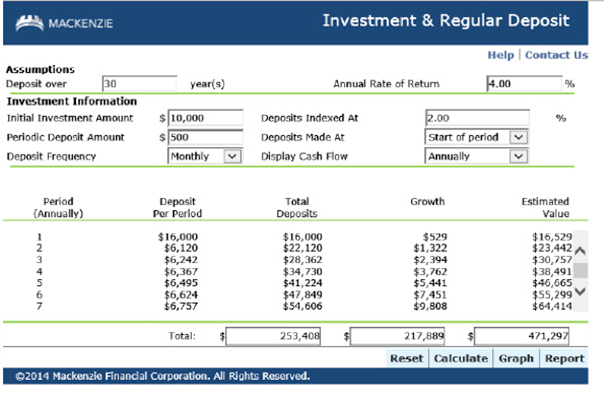

EXAMPLE 1

Let’s assume someone has 20 years left before the planned retirement and has $500 a month to invest with $10,000 already invested. If we assume a 4% rate of return and increasing the $500 a month investment by a moderate 2% each year, then at the end of 20 years there will be $238,020 in savings.

EXAMPLE 2

If we take that same person and go to the ROTHENBERG.ca calculator but change the timeframe to 30 years to invest, – same amount each month – that person will have 471,297. That’s an extra $233,000! And we are assuming the person is investing $500 a month which is a moderate amount.

EXAMPLE 3

Then if we can increase the annual rate of return (seeing an investment advisor will help) and index the deposits each year to 5% from 2%, that same person with 30 years to invest the $500 a month will end up with a whopping $804,000!

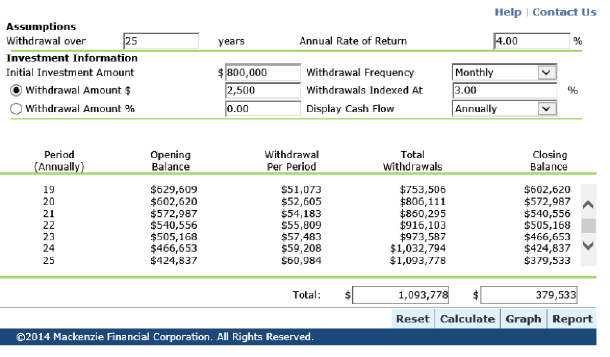

EXAMPLE “WITHDRAW”

So now, assume we have accumulated $800,000 and we are now retired. We plan to live healthy and expect to live another 25 years. Our calculators show that if you earn 4% and withdraw $2,500 a month (to enhance the government pensions) then at the end of the 25 years there will be a balance left of close to $380,000.

A good healthy, quality life is one that has to be worked on,

- proper eating habits,

- regular exercise

- social activities that will put us in touch with other people

- and a passion that can be fully developed during those retirement years.