Is the S&P 500’s 2024 rally a sign of more to come?

The S&P 500 has experienced a remarkable surge in 2024, delivering one of its strongest performances since 1928. While past performance often fuels optimism, the critical question for investors looking at the year ahead is whether this bullish trend can sustain itself for the broader equities market.

Looking back on 2024

Year-ahead-forecasts in December 2023 about what 2024 would bring for investors were dismal, even after a year of more than 20% returns for the S&P 500. Perhaps what played a part in the pessimistic outlook for 2024 was the political uncertainty and heightened emotions of an election year.

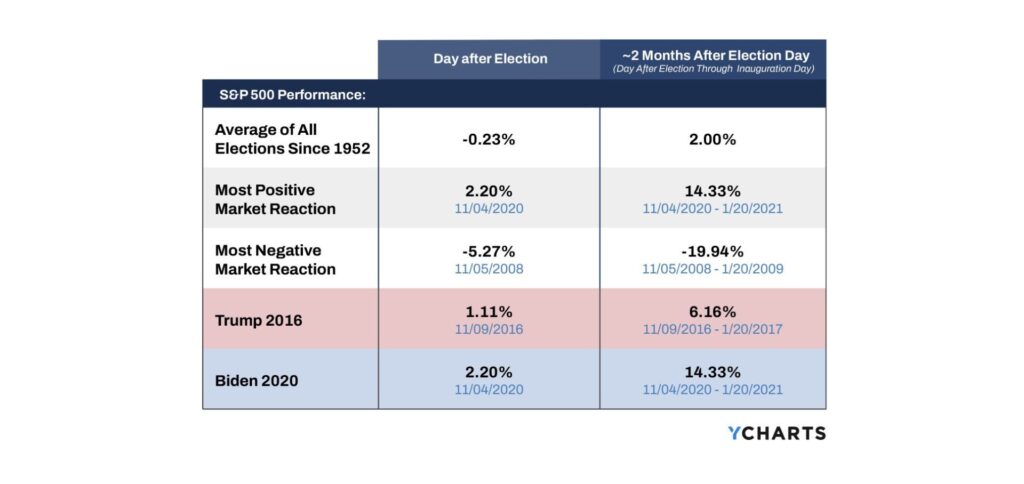

However, historical data suggests that such concerns are often overblown. The S&P 500 has not only shown resilience but posted a noticeable positive performance in 83% of election years. Any post-election losses tend to be retraced by end of year. In fact, the index generously retraces its losses, typically trading higher into the year-end and into the new year, up to two months following a U.S. election.

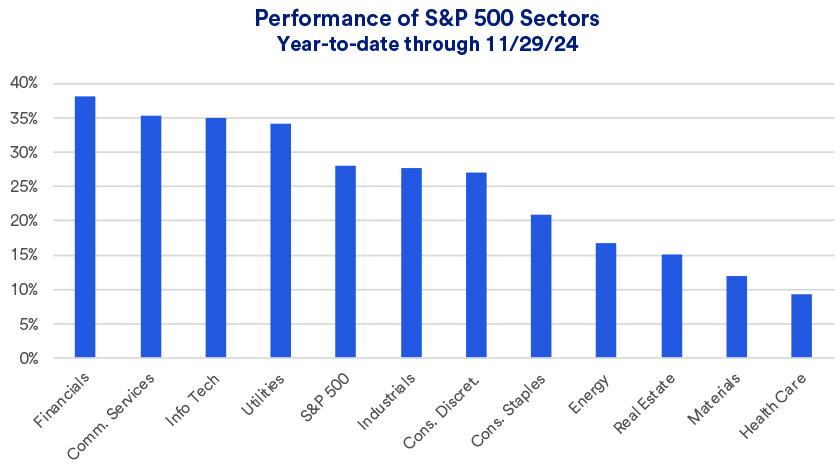

As of Dec. 13, the S&P 500 is up 27%. If it finishes up over 20%, this will represent a spectacular two-year run for the S&P 500.

Heading into 2025

Looking ahead, forecasts suggest growth potential of the S&P 500 at 9% by the end of 2025. While the outlook remains positive, the bull market could face challenges in mid-2025. Risks such as a potential economic slowdown, tightening monetary policy or geopolitical uncertainty could lead to a market pullback. And with the S&P at an all-time high currently, investors may be nervous that a market correction is on the horizon.

What does this mean for the broader equities market?

The S&P 500 is a widely used benchmark for tracking trends in the broader equities market due to its breadth and diversity. For this same reason, it provides a simplified view of market performance at best, obscuring trends within specific sectors of the economy.

Market movements are complex and driven by a combination of factors, including but not limited to domestic and foreign policies, interest rates, geopolitical events and corporate earnings. These elements often interact in ways that make it difficult to isolate the impact of any single variable—such as an election cycle.

Recently, stocks have rallied amid expectations that tax cuts, deregulation and increased government spending will spur economic growth but the long-term impact of policies such as tariffs, foreign relations and fiscal spending remains uncertain.

The complex and unpredictable nature of financial markets means that growth may not be as consistent as projected, especially if key assumptions about policy or global conditions fail to materialize.

3 Investor Takeaways for 2025

1. Time in the market vs. timing the market

Investors should look at staying invested in the market for the long term and consider high-quality stocks. Investing in solid, well-managed companies provides a stable foundation for long-term growth, even during market dips or economic uncertainty.

2. Strategic portfolio rebalancing

Strategic portfolio rebalancing can help investors to adjust sector exposure based on changing market conditions. This helps capture opportunities in sectors with favorable valuations or strong growth potential.

3. Diversification beyond equities

Investing in other asset classes beyond equities, such as fixed income or alternative investments, may help improve risk-adjusted returns and provide a hedge against market fluctuations. This approach can potentially reduce volatility and better align a portfolio with an investor’s risk tolerance and long-term objectives.

This is an important time to connect with a wealth management professional to ensure your investments are aligned with your financial objectives and that you’re on track to reach your wealth goals. Reach out to us today—we are here to assist you in making informed investment decisions and navigating the complexities of the current market landscape with confidence and clarity, ensuring you’re well-positioned to seize tomorrow’s opportunities.