Investing in GICs the right way: GIC Laddering explained

Even the most conservative investment products require disciplined strategies to maximize returns.

Do a quick Google search for ‘Best GIC rates’ and you’ll find that there are many guaranteed investment certificate (GIC) rates available from which to choose from. Having options is certainly a good thing, but it can also be a source of anxiety: How much should I invest? Which GIC term length should I pick? How can I make the most returns? What happens if interest rates fall? As with any product you’re considering purchasing, financial or other, you’re sure to have some questions.

Thankfully, there exists a tried and proven strategy called GIC laddering, which our advisors actually use, that helps to greatly reduce the guesswork and ensure your GIC investments stay ahead of any developments that could negatively impact your overall returns.

But first, what are GICs?

GICS are essentially loans you make to a bank, credit union or financial institution for a certain period of time, also known as the term. Terms can range from as little as 30 days to as long as 1-, 2-, 3-, 4- or 5-years. Typically, this money is ‘locked-in,’ which means you don’t have access to it until the GIC matures.

In return, you receive a percentage of your initial deposit as regular payouts. Depending on the GIC, you may be paid interest on a monthly, semi-annual, or yearly basis or upon maturity. The most popular ways to receive interest are through annual payouts or being paid at maturity.

Why should I invest in a GIC?

Fixed-income investments like GICs provide peace of mind and security, mainly because you don’t have to worry about losing your initial investment. In fact, your initial investment is guaranteed to be returned to you.

You also get the added comfort of knowing exactly by how much your investment will grow and, in turn, how much you’ll pocket. In the case of GICs, that means your total initial investment plus interest!

Compared to other investment products, GICs are particularly attractive because you can depend on them to provide a steady stream of income.

Adding GICs to your portfolio can also help reduce your overall investment risk. For this reason, your portfolio should include safer options that generate consistent income, such as GICs. A guarantee of income, regardless of the amount, is especially helpful in preparing for the future.

The risk-return tradeoff of GICs…

GICs are considered relatively low-risk investments, since you’re guaranteed to get back the amount you invest. However, GICs aren’t the best option if you’re looking for exceptional growth.

Just to give you an idea: As of April 2021, the highest GIC rates irrespective of term are sitting around the 2% mark. Meanwhile, the S&P 500 index (^GSPC), which is considered a good indicator of the U.S. market, delivered an average annual return of 13.6% (as of August 2020).

GICs are not a particularly good investment either if you require on-hand access to your capital; early withdrawals can result in penalties.

This said, GIC rates, like the rates for savings accounts, mortgages, and credit cards, change over time, rising or falling. While the rate is guaranteed once you lock in your money for the respective term, you can’t know for certain which direction GIC rates are headed. It’s entirely possible that a few months from now, GIC rates will be higher than they are today. It’s equally possible that they will be lower.

Since it can be such a gamble to try to predict which way GIC rates are going, it’s important to have a strategy in place that can help you get the most competitive rate(s) on the market but also protect you in the case of falling interest rates. GIC laddering does exactly that.

Here’s how GIC laddering works

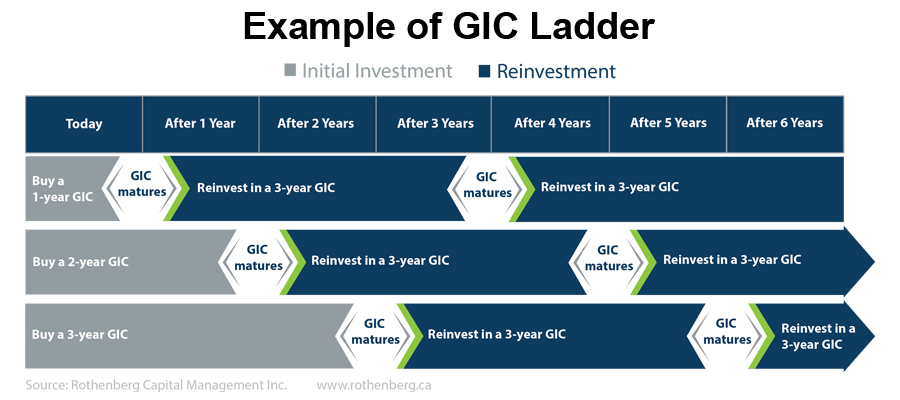

GIC laddering involves splitting the total amount you plan to invest across multiple GICs, ensuring that you have a GIC that matures each year and then reinvesting the amount that comes due at the best rate available.

GIC laddering is a strategy that focuses on purchasing GICs with different maturity dates and therefore different interest rates. This way, you don’t have to guess the direction of interest rates.

With this approach, you’ll always be getting the highest average rate of return regardless of how interest rates fluctuate and be able to capitalize on the opportunity presented by rates rising.

So, for example, you have $30,000 to invest. According to the GIC laddering strategy, you would invest $10,000 in each term. We recommend splitting your money equally between 1-, 2-, and 3-year terms. As our GIC Department Manager, Tina Patel, explains: “3 years is a good time to see all the changes and movements happening.

This would give you $10,000 of principal maturing every year for 3 years, which you can then reinvest into another 3-year GIC. The 3-year GIC rate will always be higher than say a 1-year or a 2-year rate, so you’re always getting the highest rate available. As a general rule of thumb, the longer the GIC term, the higher the interest rate.

“If the rates go up, then you have money to reinvest in a higher rate because you have a maturity coming up. If the rates go down, you protect yourself because not everything is coming due at the same time,” explains Patel.

An additional advantage of this approach is that you will always have access to part of your money as money comes due each year. So not only are you benefitting from the most competitive rates to grow your investment as much as possible, you’re also able to easily access your money in the event you need it.

As the advice goes, don’t pull all your eggs in one basket. This not only rings true for eggs, but also GICs.

Want to learn more about our GIC rates?

At Rothenberg, we shop over 20 financial institutions to find the highest GIC rates for our clients. Our website is regularly updated with the most current GIC offers: www.rothenberg.ca/gic-rates/. A Rothenberg advisor can always help you decide if investing in a GIC is right for you. Contact us here or by emailing us at inforequest@rothenberg.ca. For information about non-registered GICs, please email Tina Patel, Manager of the GIC department at t.patel@rothenberg.ca.