Early Retirement is Not a Pipe Dream, but Workers Aren’t Doing Enough of One Thing – Planning.

Statistics Canada says the average age of retirement climbed to 63 in 2015. You might want to buy yourself the freedom to stop working — or at least quit your current career — at 58, 55 or even earlier!

There are many aspects to early retirement – where to live, lifestyle, hobbies, health but a lot of retirement planning is about the money: what you need to do and not do today to be able to leave the workforce on your schedule and live the life you dream of.

Early retirement is still possible, but many workers have a hard time believing that’s the case. Nearly half of intended retirees, 47%, are worried about outliving their retirement savings, up from 37% in 2009.

According to a survey by Bankrate.com, a whopping 70% surveyed say they are concerned about depleting their retirement savings and plan to work as long as possible during retirement. 70%!

“Working during retirement brings a lot of benefits,” says Jill Cornfield, Bankrate.com retirement analyst. “I’m not surprised that nearly three-quarters of people said they’d like to work as long as they can while in retirement. It’s not just the money. When you can work as a consultant or find a part-time job, hopefully one that you will really enjoy, it helps you stay sharp.”

It is vital that those who are considering retirement, even if it is a few years away, calculate their monthly retirement income needs. The standard ‘rule of thumb’ is that retirees will need 70% to 80% of their current annual income to continue their current lifestyle in retirement. You should consider all expenses including home maintenance and upkeep, taxes, health care, and large one-time expenses like housing and cars. Also, ongoing expenses such as entertainment, dining, and gifting are all not likely to diminish. As a matter of fact, they may even increase as you will have more time for traveling, enjoying your favorite hobbies or being with your children and grandchildren.

So once you have calculated your monthly retirement income needs then you have to ensure that you will have enough pension income and savings when you do in fact decide to retire.

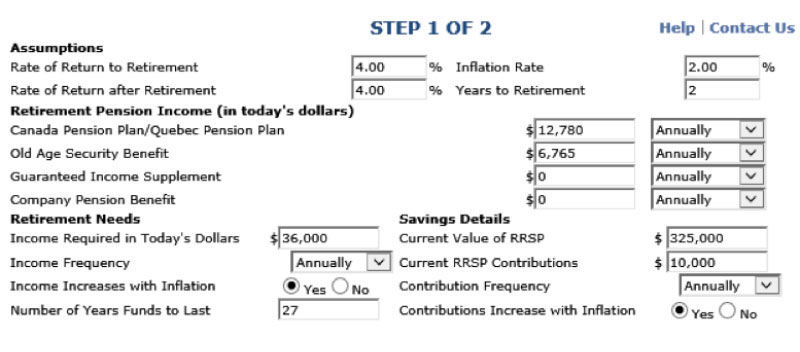

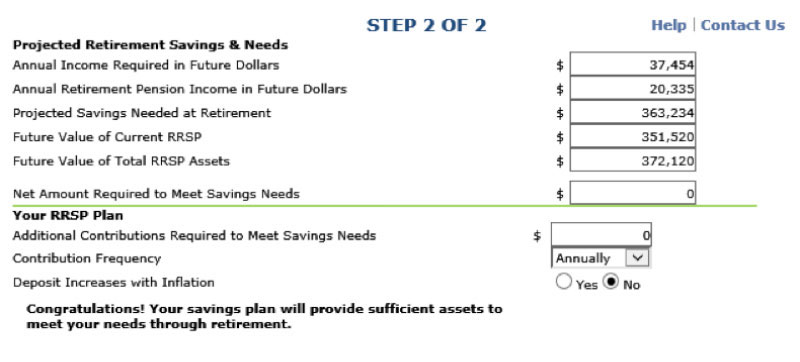

The Rothenberg website has a number of simple to use calculators that will help you run test calculations based on your own scenarios and financial goals.

Here is an example of an individual, aged 63, with life expectancy to 90 (or 27 years). His/her RRSP is currently valued at $325,000 earning a return of 4% per annum, and plans to contribute $10,000 a year for two more years. This person has no company pension. He/she has calculated that their retirement needs will be $3,000 a month or $36,000 a year.

It’s not our parents or grandparents’ retirement anymore. It is entirely possible that we might spend 20, 30, even 40 years in retirement so we have to be prepared! We can indeed retire when we want and on our terms but there is some planning involved. If you’d like to go through some custom calculations with a knowledgeable financial advisor click here for a FREE initial consultation.

It’s not our parents or grandparents’ retirement anymore. It is entirely possible that we might spend 20, 30, even 40 years in retirement so we have to be prepared! We can indeed retire when we want and on our terms but there is some planning involved. If you’d like to go through some custom calculations with a knowledgeable financial advisor click here for a FREE initial consultation.