Best Execution Public Disclosure Statement

NATIONAL BANK FINANCIAL INC.

BEST EXECUTION PUBLIC DISLOSURE STATEMENT

February 2024

BEST EXECUTION DISCLOSURE CHANGES

The following are recent changes to the NBF Best Execution public disclosure statement, which will be noted in this section for your reference, and will be maintained for at least the next 6 months.

NBF BEST EXECUTION PUBLIC DISCLOSURE STATEMENT

For clients who do not have access to the online Best Execution public disclosure statement, a hardcopy version is available upon request. All clients who request a hardcopy version, will be placed on a distribution list and will receive updates to this Best Execution public disclosure statement within 90 days of the update.

Please contact your Account Executive or Relationship Manager for further information.

DEFINITIONS

Best Execution: Obtaining the most advantageous execution terms reasonably available under the circumstances.

Over-The-Counter (OTC) Securities: Securities traded through a dealer network rather than through a centralized formal exchange.

Foreign Exchange-Traded Security: Security listed on a foreign organized regulated market.

Foreign Organized Regulated Market (FORM): Market outside of Canada which is an exchange, quotation or trade reporting system, alternative trading system or similar facility recognized by or registered with a securities regulatory authority that is an ordinary member of the International Organization of Securities Commissions.

Order Protection Rule (OPR): The Order Protection Rule requires marketplaces to establish, maintain and ensure compliance with written policies and procedures reasonably designed to prevent inferior-priced orders from “trading through”, or executing before, immediately accessible, visible, better-priced limit orders.

Protected Marketplaces: Marketplaces that will display orders that are considered “protected orders” pursuant to the OPR.

Smart Order Router (SOR): Software to optimize execution by using advanced routing rules and algorithms when directing orders to multiple marketplaces.

Speed Bump: Systematic order processing delay.

Unprotected Marketplaces: Marketplaces not displaying protected orders.

BEST EXECUTION OVERVIEW

National Bank Financial Inc. (NBF) is committed to using all reasonable efforts to ensure that clients achieve Best Execution of their orders in respect to all securities, including listed securities, foreign-exchange traded securities and transactions in OTC securities. At NBF, our main endeavor is to constantly strive to achieve Best Execution for all clients, while providing consistent liquidity to all Canadian marketplaces.

NBF Best Execution Policy (the “Policy”) applies to all divisions under NBF, including: National Bank Financial Markets (NBFM), National Bank Financial Wealth Management, National Bank Direct Brokerage (NBDB), and National Bank Independent Networks (NBIN). This Policy also applies to National Bank of Canada Financial Inc. (NBCFI), an affiliate of NBF.

This Policy meets CIRO requirements under Rule 3100 (Part C) – Best Execution of Client Orders:

- Outlines the process designed to achieve Best Execution for all clients

- Explains how NBF follows the instructions of the client

- Explains the process for order and trade information from all appropriate

marketplaces and FORM - Describes how NBF evaluates whether Best Execution was obtained from an overall perspective

This Policy is also intended to meet Best Execution requirements under the following, but not limited to:

- Rules of Bourse de Montréal, Article 7.3 – Best Execution Required

- FINRA Rule 5310 – Best Execution and Inter-positioninG

- FINRA Rule 2121 – Fair Prices and Commissions

Best Execution represents the obligation on marketplace participants to diligently pursue the execution of each client order on the most advantageous execution terms reasonably available under prevailing market conditions at the time of execution. Best Execution includes but is not limited to the best price available at the time of execution. It also includes optimizing liquidity, minimizing order signaling effects, speed and certainty of execution.

Best Execution Criteria Considerations:

- Price at which the trade would occur

- Speed of execution

- Certainty of execution / % Fill Criteria

- Overall cost of execution

- Market disclosure/signaling

- Prices and volumes of the last sale and previous trades

- Prevailing market conditions at the time of execution

- Direction of the market for the security

- Posted size on the bid and offer

- Size of the spread

- Liquidity of the security

- Execution quality over the order duration, determines the price at which the order was executed relative to the time of entry and average execution price over the time in which the order was actively traded in the market

- Client instructions when received, are always considered and will execute the order in accordance with those instructions, so far as reasonably possible

- FORM including the consideration of FX rates

NBF meets its Best Execution obligations to client orders through:

- Use of SOR technology: NBF will utilize comprehensive SOR technology that is available and relevant to the trading strategy and the particular execution venue. NBF is responsible for adjusting its own SOR strategies, also utilizing Third-Party SORs and in majority applies a spray strategy for order routing.

- Provision of client liquidity: In order to minimize price, certainty of execution, and adverse market signaling impacts of large client order types, NBF may at its discretion enhance visible market liquidity though the provision of principal liquidity facilitation.

- Marketplace access/information: NBF is a member of all Canadian marketplaces. Information from all marketplaces (including unprotected marketplaces, protected marketplaces, and FORM) are considered in accordance to the Best Execution criteria considerations.

- Unprotected Marketplaces: Unprotected Marketplaces are considered if that marketplace has demonstrated a reasonable likelihood of liquidity for a specific security relative to the size of the client order.

- Speed Bumps: Marketplaces with Speed Bumps are considered if that marketplace has demonstrated a reasonable likelihood of liquidity for a specific security relative to the size of the client order.

- Access dark liquidity: NBF will access dark liquidity facilities when market factors indicate a reasonable likelihood of material liquidity for a security in these trading venues.

- Access FORM: NBF will access FORM liquidity in a security when market factors indicate this can be accomplished on terms advantageous to the client in the context of both price and other execution factors with considerations given to Canadian marketplace conditions.

- Monitoring order execution quality: NBF performs periodic, systemic reviews of order routing criteria to ensure optimum routing for client orders and review order execution performance against relevant quantitative metrics.

- Personnel: NBF is committed to employing professional and experienced trading personnel capable of evaluating market characteristics and suitable execution strategies in the context of market conditions. Trading personnel are registered with CIRO, where required, and have a responsibility to comply with their continuing educations requirements.

HOURS OF OPERATION FOR TRADING IN LISTED CANADIAN SECURITIES

Hours of Operation

Exchanges in Canada offer trading between the hours of 9:30 a.m. and 4:00 p.m., Eastern Standard Time (EST0), Monday through Friday, not including statutory Canadian holidays. Most Alternative Trading Systems (ATS) in Canada offer trading between the hours of 8:00 a.m. and 5:00 PM EST. Client orders placed during normal business hours will be transmitted to the NBF trading staff or trading systems and executed based on the instructions of the client and in accordance with the hours of operation on the market where the order is placed.

Pre-Open/Opening Auction

For marketplaces that support an opening auction, trade allocation and imbalance/price volatility management methodology may differ. An order received prior to 9:30 a.m. EST will be booked to the pre-opening of the principal listed marketplace for that particular security. Orders may be entered on a marketplace that offers trading prior to 9:30 a.m. EST.

Post-open/ Continuous Auction

Where markets support an opening auction, unfilled orders from the auction will rollover to the post-open market session of the market that they were entered on. New Market and Limit Orders received by NBF during the Post-open session will be routed using a smart order router that will direct the order to the best available market at the time of receipt. Changes to an outstanding order, or a portion of an outstanding order, will be handled in the same capacity as if a new order was received.

Orders received after 4 p.m.

An order received after 4:00 p.m. EST is typically held for transmission until the next business day and will be booked to the pre-opening on the principal listed marketplace. Orders may be entered on a marketplace that offers after-hour trading if specifically directed per client instructions.

ORDER HANDLING

Order Execution

In a multiple marketplace environment, certain types of orders may have specific handling implications. Unless otherwise specified, orders will be handled in accordance with the description provided in this document. Duration refers to the lifespan of the order within a trading system.

Day Orders

A Day Order instructs the receiving marketplace to automatically expire the order if it is not executed in the same trading day.

Good Till Date Orders

Good Till Date Orders (GTD) have an order duration that specify that the order remain open until it is either filled or until it expires at a specified date.

Order Types

Market Order

A market order is an order to buy or sell a security at prevailing prices available in the marketplace at the time of order entry. Market Orders are therefore used when certainty of execution is a priority over price of execution. Caution should be taken given the different treatment that market orders receive in a multiple market environment. NBF will route market orders through its automated system that examines each available marketplace and enters the order in the market that secures the best price.

Limit Order

A Limit Order is an order for a security at a specific minimum sale price or a maximum purchase price not to be exceeded. A limit order provides control over the execution price but reduces the certainty of execution. If a Limit Order is not immediately executable, NBF will route this order to the marketplace, which in its judgment, provides the Best Execution possibility. These orders will remain until the order is filled, cancelled or expired.

Special Terms Orders

Special Terms Orders are orders with specific terms that are not executable in the regular marketplace.

These orders are only booked to the Special Terms Market of the principal listed marketplace, unless they are immediately executable on an alternative marketplace at the time of entry. Any unfilled portions of the Special Terms Orders will expire at the close of the principal listed marketplace. Note that the use of special terms orders can delay or decrease the chance of execution, as the receiving market must ensure the “special terms” of the order are satisfied prior to executing the order.

Stop Loss Orders

Stop Loss Orders are orders that are triggered when a board lot trades at or through the stop price (trigger price) on the principal marketplace of that security.

Market on Close Orders

Market on Close (MOC) Orders are intended to trade at the calculated closing price of the principal listed marketplace. To participate in the MOC, orders must be received by 3:40 p.m. and can be both Market and Limit MOC Orders. Offsetting MOC Limit orders can be entered to satisfy the imbalance published from 3:40 p.m. until 4:00 p.m. The principal listed marketplace will then calculate the closing price and publish the trades at 4:10 p.m. There is no guarantee that the MOC Order will be completed. The TSX MOC is an anonymous price facility, so the price and volume information will not be known until after executions have completed.

NBF TREATMENT OF MARKETPLACE TRADING FEES, REBATES, AND PAYMENT FOR ORDER FLOW

NBF does not charge marketplace trading fees or pass on marketplace rebates onto clients. However, “Cost-Plus” arrangements may be available to certain eligible clients, under which the client is ultimately responsible for their own marketplace trading fees and rebates.

BEST EXECUTION GOVERNANCE

Best Execution Committee

NBF trading products Best Execution Committee meets at least quarterly with ad hoc meetings as required (new marketplace, change in liquidity patterns, change in fees, technology, and market place events, etc.). The principal purpose of the committee is to ensure the ongoing integrity of NBF’s Best Execution regime.

Mandate

- Ensure NBF Best Execution Policies remain current in the context of market and regulatory developments

- Ensure order routing logic is consistent between trading applications, where applicable

- Ensure that order routing criteria is consistent with the goal of optimizing client order executioN

- Review order routing assignments on a periodic basis to ensure the assignments are consistent with optimized client order execution

- Review Best Execution quality criteria and metrics on an ongoing basis and re-evaluate quantitative and qualitative valuation criteria as required

- Review trading technology to ensure most appropriate applications are implemented

- Review NBF Best Execution Policy and public disclosure statement at least annually and/or after each material change to the trading environment or market structure that warrants a review

- Ensure pricing for OTC securities are considered “fair and reasonable”

ORDER ROUTING CRITERIA

NBF evaluates order routing based on the criteria noted below. NBF does not take into consideration our ownership or partnership of a marketplace into our routing strategy. It is our philosophy that marketplace liquidity, primarily defined by traded volume, represents the single, best indicator of the potential for superior client order execution. However, NBF believes technology considerations and innovation as well as other factors are an important consideration in determining the most appropriate default order routing criteria. Marketplace liquidity combined with qualitative evaluation of factors noted below are used to determine the appropriate order routing destination for individual securities.

Order Routing Criteria:

- Volume

- Order to trade ratios

- Technology and support

- broker attribution

- Market making and primary markets

- Costs and rebate models

- Other criteria influencing Retail & Institutional Routing Strategy

- Latency of execution

- Latency of data

- Client preference

- Potential crossing/internalization opportunities

TECHNICAL AND SELF-HELP

This Policy dictates the diligent pursuit of the execution of client orders on the most advantageous terms reasonably available. Part of this Policy necessitates the execution of client orders at the best price available at the time of execution and based on the client instructions.

Consistent with our Best Execution obligations, NBF endeavors under all circumstances to access visible liquidity on all marketplaces at the best price available at the time of execution. NBF management may invoke “Technical-Help” in the event there are reasonable grounds to believe client executions may be adversely affected by system malfunctions or excessive latency originating from a marketplace system malfunction, vendor infrastructure, or proprietary systems. When dealing with a marketplace that is experiencing a failure, malfunction or material delay of its systems, equipment or ability to disseminate marketplace data of a temporary or longer-term nature, NBF may rely on “Self-help” in these particular circumstances.

If either “Technical-Help” or “Self-Help” is invoked, the affected marketplace may be removed from existing SOR systems until such time as the cause of the malfunction has been determined and there are reasonable grounds to believe that the identified issues have been resolved. In addition, NBF Compliance will advise the marketplace, CIRO Market Surveillance and any relevant application vendors. NBF will endeavor to limit the impact of “Technical-Help” or “Self-Help” to affected systems and SOR’s with the primary consideration being the preservation of Best Execution on behalf of our clients.

EXECUTION ON FOREIGN MARKETPLACES

Orders for Canadian and non-Canadian listed equities to be traded on marketplaces outside of Canada may be executed by third party broker dealers (“Third Parties”). Third Parties may execute such orders as either agent or principal. The fees or commissions charged to us by Third Parties for such orders may be reported as a net price.

For Third Parties who may execute order flow on behalf of NBF, the following steps are taken to ensure that each Third Party has policies and procedure in place that are reasonably designed to achieve Best Execution for our clients (Third Party Best Execution Policy):

- NBF will perform both an initial and annual review of each Third-Party Best Execution Policy, where applicable, and a determination is made whether it will effectively achieve Best Execution for our clients

- NBF will also perform an ad hoc review of a Third-Party Best Execution Policy, where applicable, should a Third Party undertake a material change to the trading environment or market structure that warrants a review

- NBF will follow up with each Third Party should NBF identify any execution results that are inconsistent with the Third-Party Best Execution Policy

NBF accesses foreign market liquidity in a security when market factors indicate this can be accomplished on terms advantageous to the client in the context of both price and other Best Execution factors with considerations given to Canadian marketplace conditions. Conversions to Canadian dollar currency are processed at current FX rates to ensure that the required conditions are met beneficial to the client.

NBF does not have any agreements regarding the sending of orders outside of Canada.

OVER THE COUNTER (OTC) FAIR PRICING

An aggregate fair and reasonable price will be used for executing over the counter securities (OTC) including fixed income, contracts for difference, and foreign exchange contracts excluding primary market transactions and OTC derivatives with non-standardized contract terms.

“Reasonable efforts” must be made to provide or procure a fair market price for each order under the circumstances of the prevailing market conditions. Markup/down, commissions, and services charges cannot be excessive. A markup/down refers to remuneration on a principal transaction. It is an amount added and subtracted from the price in the case of a purchases and sale respectively. Commissions and services charges are forms of compensation for agency transactions .

CONFLICTS OF INTEREST RELATING TO BEST EXECUTION

NBF considers a conflict of interest to be any circumstance where the interests of different parties, such as the interests of a client and those of NBF, are inconsistent or divergent. NBF takes reasonable steps to identify all existing material conflicts of interest, and those we would reasonably expect to arise with regards to Best Execution.

TMX Group Limited

National Bank Acquisition Holding Inc., one of our affiliates, owns or controls an equity interest in TMX Group Limited and has a nominee director serving on the board. In addition, NBF is a wholly-owned subsidiary of National Bank of Canada. From time to time, National Bank of Canada may enter into lending or financial arrangements with companies that are the subject of research reports or that are recommended by related entities.

REQUEST FOR ADDITIONAL INFORMATION

If you have any questions about this public disclosure statement, please contact your Account Executive or Relationship Manager.

DISCLAIMERS

This document is the property of National Bank Financial Inc and its subsidiaries and, in certain cases, may be owned by third parties. This document may not be reproduced or distributed, in whole or in part, for commercial purposes without the prior express written consent of National Bank Financial Inc. The particulars contained herein were obtained from sources which we believe to be reliable but are not guaranteed by us and may be incomplete. This document has been prepared solely for informational purposes only and is not intended to provide financial, legal, accounting or tax advice and should not be relied upon in that regard. The information provided is as of the date hereof and is subject to change without notice.

National Bank Financial Inc. is a Canadian investment dealer and an indirect wholly-owned subsidiary of National Bank of Canada. National Bank Financial Inc. is an investment dealer registered in all the Canadian provinces and territories and a member of the Canadian Investment Regulatory Organization of Canada and the Canadian Investor Protection Fund.

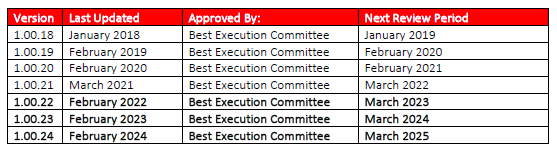

HISTORY OF REVIEW