How does inflation impact my retirement plans and savings?

With inflation at a nearly 40-year high, you might be worried about what it means for you retirement. In this article, we go over some things you can expect, whether you’re in the process of planning for retirement or are already retired.

You may have noticed a spike in certain expenses recently, such as your groceries, rent and gas bills and you may be wondering why this is happening. The reason is inflation. Inflation occurs when there is a broad increase in the prices of goods and services. But inflation doesn’t only impact your spending habits. It also affects your ability to save for big life goals like retirement and enjoy your golden years as you should.

I’m saving for retirement. How does inflation impact me?

As your expenses go up with inflation, your financial priorities will most likely shift, and saving for retirement may move down the list. You may even find it difficult to put aside funds on a regular basis since you first must pay for things like food and gas. In extreme situations, you might even have to dip into your savings to compensate for overspending. When your income remains the same, but the cost of living keeps going up this is certainly a possibility.

Your first instinct may be to reduce or cut back entirely on otherwise regular contributions to your retirement accounts until things subside and prices return to something-like-normal. However, you should avoid giving in to this urge. Even if you’re only considering reducing or ceasing your contributions for a short period of time, this can have drastic effects on your nest egg.

Compound interest earned on the funds you save and invest for your retirement on a consistent basis will help your savings increase more quickly over time. Imagine the size of a snowball increasing as it tumbles down a slope and gains momentum. Compound interest works in a similar way.

By continuing to make regular contributions to your retirement accounts, you ensure that you enjoy the full power of compound interest. On the other hand, when you reduce or stop your contributions to your retirement savings, this could result in thousands of dollars less in retirement savings over the long term.

Consider the following example. Let’s say Bob starts with $2,000 in his RRSP and invests an additional $2,000 per year towards his retirement for the next 30 years. We’ll assume a 7 percent return every year to keep things simple. Bob’s RRSP would be worth $202,146. Now if Bob decides to stop contributing to his RRSP in year six and seven due to inflation, he will end up with $181,146 in total savings, which creates a $21,000 difference by the end of year 30.

While we do not recommend reducing your spending on necessities such as food, if you fear you may have to lower the amount or frequency of your contributions, you can free up some funds by eliminating non-essential expenses, such as dining out or subscription services.

Budget cutbacks can only go so far in any event, so you should definitely have a conversation about this matter with your wealth management advisor. Your advisor will be able to guide you through the process of adjusting your retirement planning strategy and investment portfolio in a way that has the least amount of impact on the quality of your life at the current moment and the best possible outcome for your retirement.

I’m already retired. What does inflation mean for me?

With so much time and effort involved in planning and saving for your retirement, as a retiree, you are certainly wondering if you’ve saved enough, how long your money will last and if you will need to adjust some of your highly anticipated plans as inflation rises. The answer depends on a few factors. Among them, your cash flow, your expenses and how willing you are to compromise on things if need be.

Since you are no longer working as a retiree, your income tends to be more predictable, and your expenses tend to become more stable as well. Your personal savings and your investment portfolio are most likely your main source of cash flow during this period in your life. You may also rely on government pensions, such as CPP, Old Age Security (OAS), and GIS for retirement income.

While your personal savings and ongoing investments will likely be the most affected by rising inflation, as your purchasing power decreases and the markets respond, the federal retirement benefits you’re receiving will see less of a negative impact.

Government-funded programs like CPP, OAS and GIS are indexed for inflation, which means that they are adjusted to keep pace with inflation, although using different formulas. So, you will likely receive an increase in the payout amounts as the government tries to account for the rapidly rising cost of living.

However, it remains important to note that if the rate of inflation outpaces the adjustment rate, it will not entirely offset inflation. So, you may find, after you spend on your basic expenses, like rent, utilities and groceries, that you have less left over for the really exciting activities on your bucket list. It then becomes a balancing act between carrying on as planned with your retirement and making concessions, especially when your expenses exceed your income. This can be the case if you have goals or hobbies you’re determined to hang on to.

If you’re healthy, travelling is probably one of the top items on your retirement bucket list. You’ve most likely saved up for this lofty goal as it can be costly. Unfortunately, when inflation is up, it can be more expensive to travel than you anticipated.

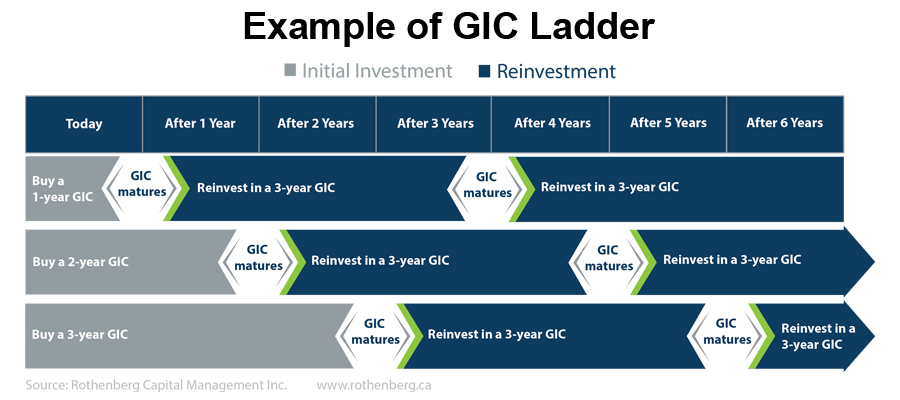

But there are also some silver linings to inflation, such as interest rates rising. You’ll find that rates for annuities like GICs, as an example, should go up during periods of inflation.

Another advantage is in real estate. For those who still own their home and are looking for the best time to sell it, during periods of inflation, real estate prices tend to go up. What this means is that it might actually be the best time to sell your home when inflation rising.

Of course, like any situation, there are both positives and negatives and these must be weighed against each other. If you are to draw any conclusions, the bottom line is this: If your expenses exceed your income, which is entirely possible, as the cost of living rises with inflation, you may be forced to choose between delaying your retirement or moving forward as planned but making some concessions.

If you are just transitioning into retirement, you may decide to work longer to generate more income to do the things you initially planned and cope with rising expenses. If you are in retirement and do not plan on returning to the workforce, you may opt for lower-cost alternatives to everyday products to offset inflation costs.

It’s understandable to be concerned about how inflation will affect your freedom and flexibility during retirement. The strategies to mitigate the effects of inflation on your retirement savings and plans will differ from person-to-person depending on your unique situation. It’s always best to touch base with your wealth management advisor if you feel even slightly concerned about how inflation will impact your retirement.

While this article been carefully checked, we cannot and do not guarantee that the information provided is correct, accurate or current. Please speak to your Rothenberg Wealth Management advisor for advice based on your unique circumstances. Rothenberg Capital Management is a member of IIROC and the Canadian Investor Protection Fund.