Those who are not yet retired can only imagine what life will be like after work. The vision of carefree days, with no boss or alarm clock, is very clear for some—they see themselves traveling around the world, writing the great American novel, or relaxing with family.

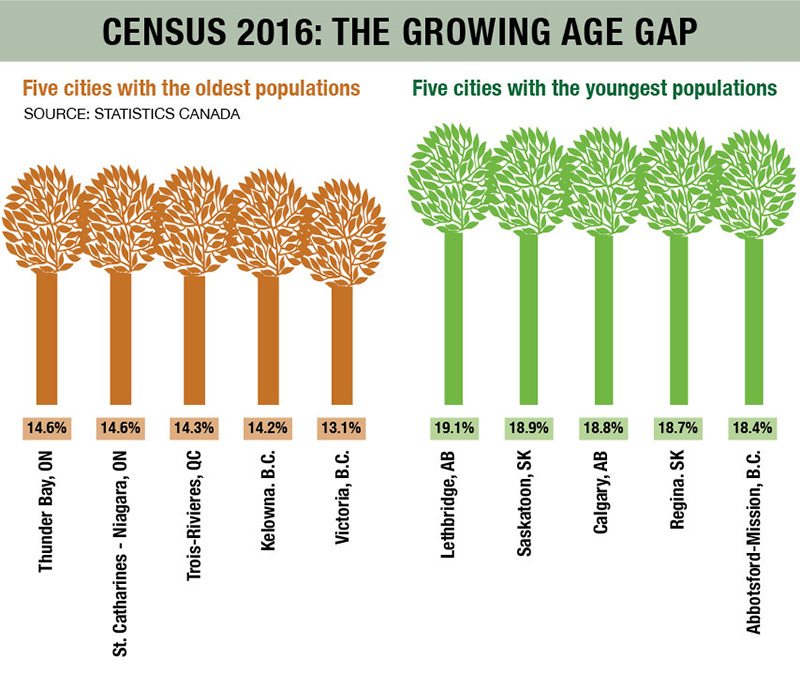

Others just hold a vague notion that life will somehow be better than it is now. Yet it seems that however clear or cloudy their notions about retirement are, folks universally hope that the money will take care of itself. That’s what “retirement” is, after all—shifting to a phase of life when something other than daily work becomes the primary source of income.

But of course, for that shift to go smoothly, planning has to happen. And a big part of the planning is figuring out what life in retirement will actually be like.

In our July blog we discussed various considerations important for the decision of where to retire. Today we wish to examine additional aspects.

Here are some key questions to ask yourself.

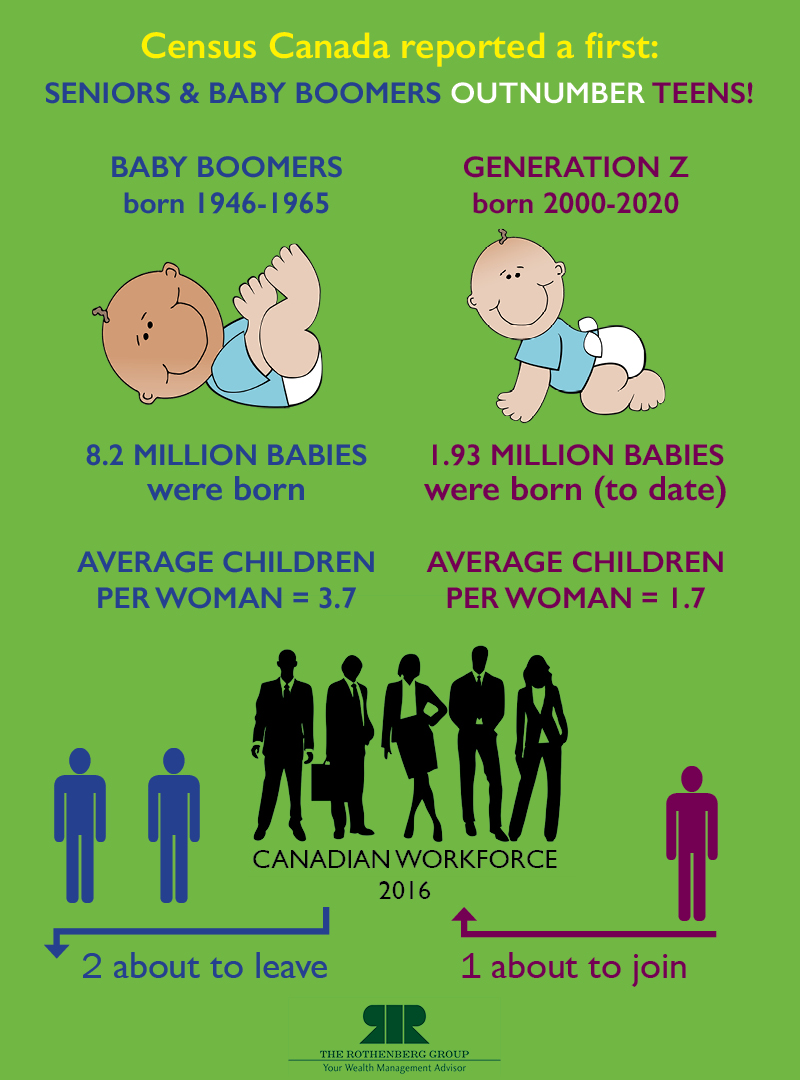

Where will you live?

The answer to this question affects not only housing costs but other living costs as well. Consider:

Proximity to children and grandchildren. If you want to live near your children then you might have to build travel costs into your budgets and/or have extra space in your homes for when the family comes to visit. Far from downsizing into condos, some retirees actually move into larger homes to accommodate family gatherings.

Travel plans. If travel is expected to play a big part in your retirement plans, you might opt for an inexpensive condo near the airport (with no plants or pets), at least until the wanderlust subsides. If and when it does, then you can reconsider the housing question again.

Affordability. The ideal way to plan for retirement is to envision the perfect life and work toward it. But many people—especially those in their 60s—don’t have that option. If you would rather retire sooner on less income rather than work extra years, the where-will-you-live question might better be phrased “Where can you afford to live?”

Key factors in assessing your living costs are the price of housing as well as the cost of food, utilities, and transportation.

What will you do?

Employment and business opportunities. Many retirees plan to work during retirement. If so, you should consider the job market for the type of work you now want to do, or the business climate if you plan on starting a new business. Obviously, working during retirement generates income— But at the very least, working—even volunteer work—keeps retirees occupied so they are less inclined to fill their days with activities that impact their expenses.

Expense-generating activities. Even classic low-cost activities such as gardening require trips to the nursery. This is not to say you shouldn’t indulge in your favorite hobbies during retirement—just that these expenses will have to be factored in to the budget.

How will you live?

The rule of thumb that says clients will need 80% of their pre-retirement income in retirement does not take into account the fact that most retired people these days have not only the time, but also the energy, to live it up!

So you have to ask yourself how simple or extravagant a lifestyle you expect to lead:

The simple life. A modest home. Most meals at home. Inexpensive vacations like road trips and low cost excursions. Mid-priced car. No lavish spending on entertainment, clothes, or other items. Inexpensive or free hobbies.

The high life. One or more well-appointed homes. Lots of meals out. Extensive, high-end vacations. Luxury car. Expensive cultural activities like theater, concerts, or season tickets to sporting events. Expensive hobbies like golf, wine, or photography.

How will your health hold up?

Health status impacts the retirement budget in two ways: it determines whether or not you will be able to work (and for how long). It also impacts life expectancy (see next question), which ultimately determines how long the retirement nest egg will need to last. Ironically, the healthier you are, the more attention you must pay to long term care: It is usually the oldest who need in-home or nursing homes care which is expensive.

To answer the health question, you should check your family history to see what health issues you may likely face. Also take into account lifestyle factors such as exercise, and nutrition. Regular physical checkups will also help keep tabs on your health status.

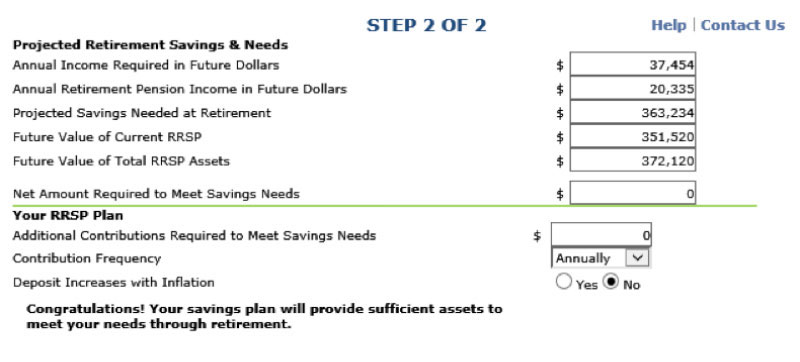

How long do you expect to live?

This is the million-dollar question. No amount of charts and graphs will accurately establish an individual’s true life expectancy. The safe route is to plan for your retirement income to last to age 90.

You might be a person who has already thought through your vision for retirement and then you may find these questions easy to answer. Others may need help getting a fix on what life in retirement will bring.

Investment Advisors at Rothenberg Capital Management are carefully trained to help clients approach such issues, which may be daunting to face alone.

The Rothenberg Advisors have the expertise and the tools to help you find a constructive starting point. Call 1.800.811.0527 to schedule a free consultation with an experienced Investment Advisor.

You can also ask an advisor to contact you.